Google has begun testing a stripped-down version of its hotel search feature in Germany, Belgium, and Estonia. The experiment replaces detailed search features like maps and hotel listings with a basic “ten blue links” format, offering only direct links to hotel websites and comparison platforms.

This shift stems from compliance with the EU Digital Markets Act (DMA), which aims to curb the dominance of tech giants and foster fair competition. While this is a temporary test, it could signal changes that hotel marketers need to prepare for.

What’s Changing?

In these three countries, Google’s hotel search results will:

- Remove Maps: No more interactive maps to locate properties.

- Remove Hotel Listings: Users won’t see hotel details or pricing within the search results.

- Revert to Basic Links: Results will only display links to hotel websites and comparison sites.

Notably, these results exclude any links to Google Travel.

This stripped-down approach is already being interpreted by some as a strategic move as Google navigates regulatory pressures from the European Commission and parts of the travel industry regarding its compliance with the Digital Markets Act.

Before diving into the dynamics between Google and the European Commission, let’s look at how this test contrasts with regular search results.

How A Regular Search Looks Like

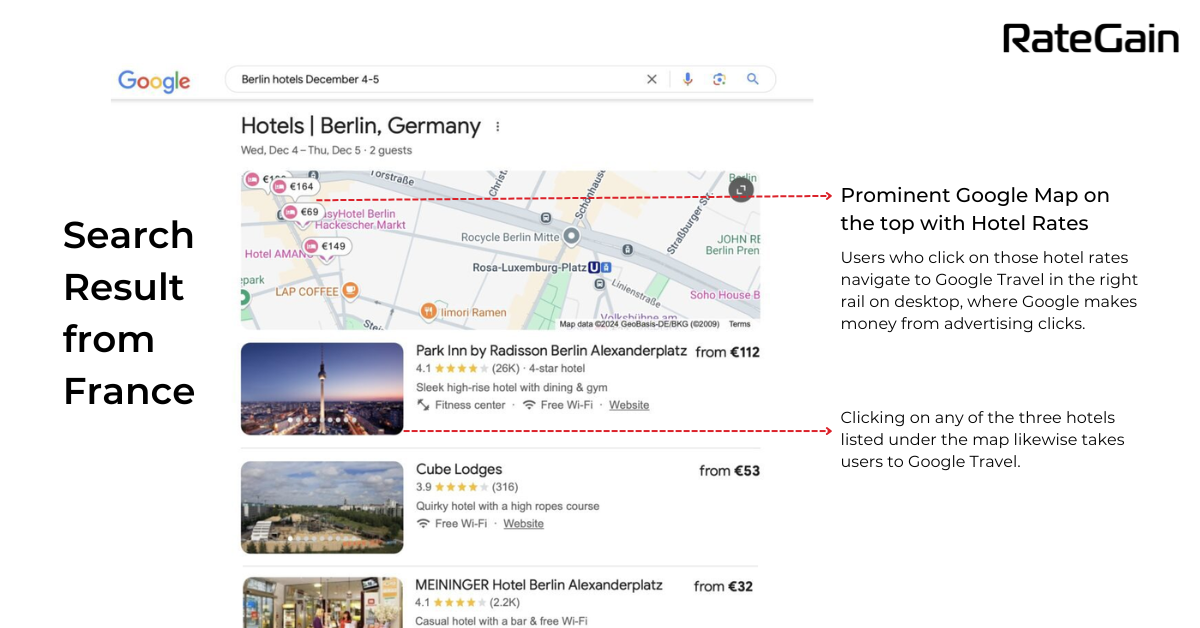

Below is a screenshot showing searches for “Berlin hotels December 4-5” from France and other regions where the test isn’t active.

In the regular format, a Google Map occupies prime real estate at the top, complete with hotel rates. Clicking on these rates directs users to Google Travel, prominently displayed on the desktop’s right-hand rail, where Google monetizes through advertising clicks. Similarly, selecting any hotel listed below the map also leads to Google Travel.

Critics’ Perspective

Critics argue that Google’s dominance in search, coupled with the preferential placement of Google Travel links, creates an uneven playing field, disadvantaging competitors.

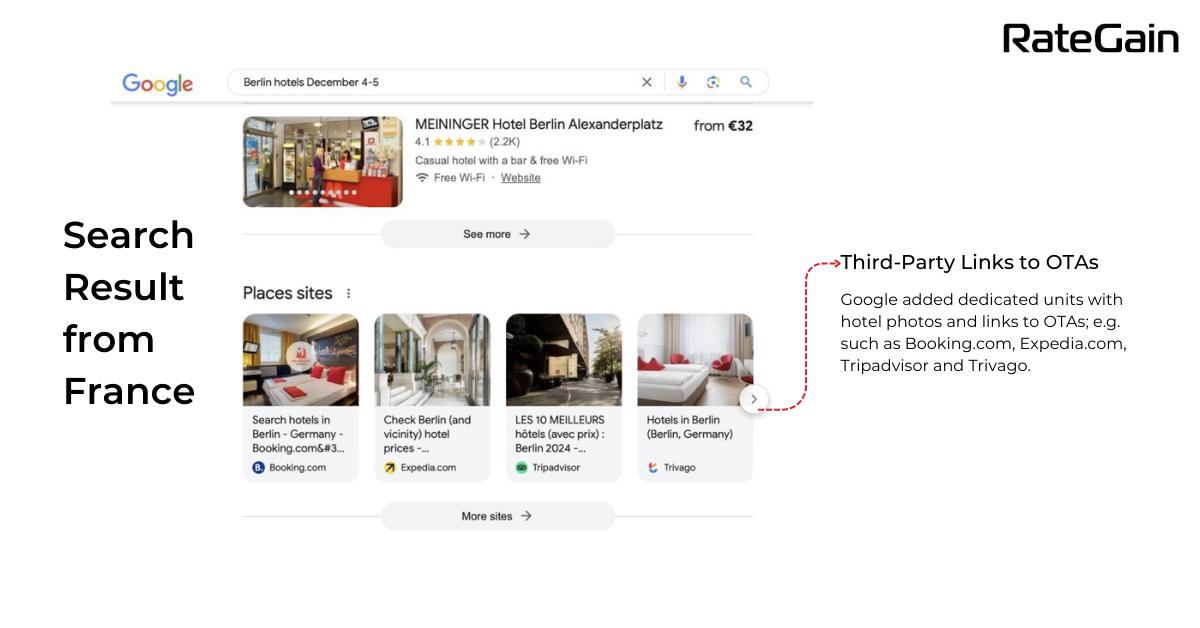

Third-Party Platforms Featured

In March 2024, Google introduced new result formats. These included dedicated units featuring hotel photos and links to third-party platforms like Booking.com, Expedia, Tripadvisor, and Trivago. As seen in the second screenshot, these appear at the bottom of the search results.

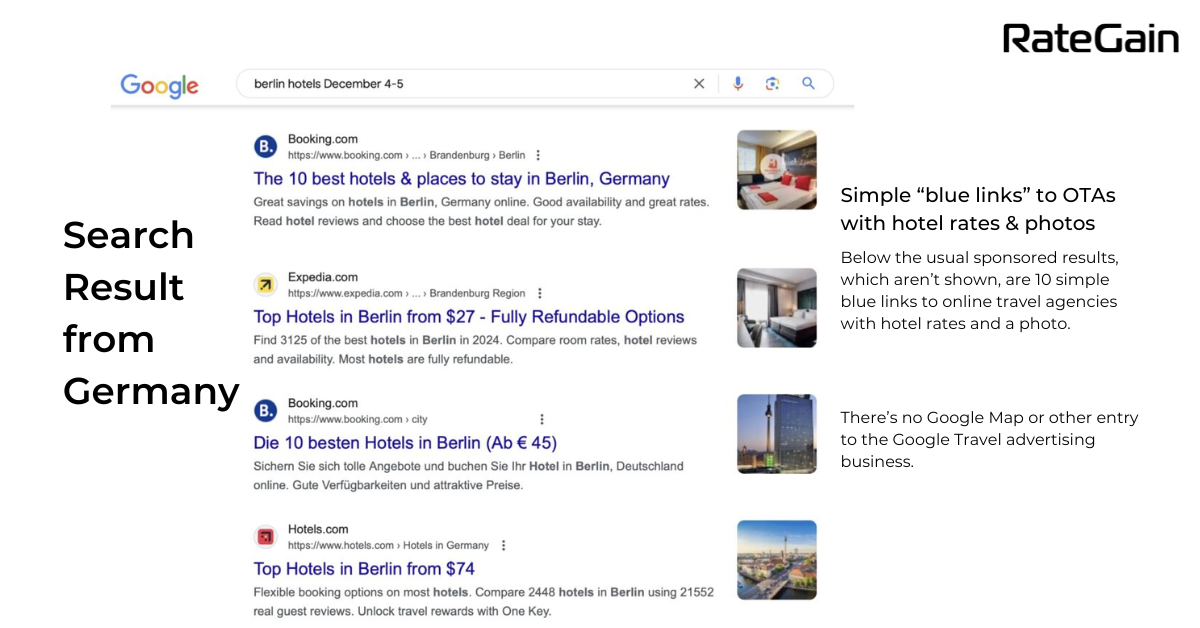

The Blue-Links Test

The third screenshot highlights the minimalistic design currently being tested in Germany, Belgium, and Estonia. Maps and Google Travel links are absent, replaced by basic links to hotel and comparison websites, returning to the bare-bones “10 blue links” format.

Why Is Google Testing This?

The Digital Markets Act has pressured Google to address competition concerns, particularly from travel aggregators and comparison websites. Over the past year, Google has implemented over 20 updates to its search functionality, some of which have benefited comparison platforms while reducing visibility for direct bookings.

Impact So Far

- Major aggregators gain visibility.

- Smaller businesses, including independent hotels, report a 30% drop in free direct booking clicks.

This test evaluates whether the simpler format will satisfy regulators while balancing user experience and traffic distribution.

Key Implications for Hotel Marketers

1. Shift in Traffic Sources

With no maps or detailed listings, organic traffic from Google might decline. Hotels that rely on direct search visibility could face a competitive disadvantage.

What to do:

- Optimize your website for organic search with clear, user-friendly content.

- Leverage comparison platforms to maintain visibility.

2. Increased Competition on Comparison Sites

As comparison platforms gain prominence, hotels may face intensified competition for placements.

What to do:

- Fine-tune your pricing and promotional strategies on OTAs and metasearch engines.

- Invest in paid advertising to secure top positions.

3. Focus on User Intent

With fewer interactive tools, searchers may arrive on your site with clearer booking intent. This makes a strong conversion rate optimization (CRO) strategy vital.

What to do:

- Ensure your website is optimized for fast load times, seamless navigation, and mobile usability.

- Highlight unique selling points (USPs) such as amenities, deals, and location benefits.

The Journey Ahead: A 2025 Perspective

The European Commission is currently investigating whether Google’s practices align with the Digital Markets Act (DMA), with the probe set to conclude by March 2025. Should Google fail to comply with the Commission’s findings, it could face significant fines.

Google’s Proposed Adjustments

In response to regulatory scrutiny and the DMA requirements, Google has offered the following alternatives to its March updates:

- Dedicated Units for Travel Intermediaries and Suppliers: Google proposes adding separate sections for flights, hotels, and restaurants, showcasing both online travel intermediaries and supplier websites.

- Enhanced Formats for Online Travel Companies and Suppliers: These new formats would include prices and photos, unlike the current setup, where units for travel companies often lack pricing details.

- New Units for Travel Comparison Websites: Google plans to introduce dedicated sections exclusively for travel comparison platforms, potentially improving their visibility in search results.

These proposals aim to address criticisms of favoritism toward Google Travel while offering more equitable visibility for competitors in the travel industry. However, the European Commission’s investigation will determine whether these changes sufficiently meet DMA requirements.

Key Question: Will these proposals strike the right balance between user experience, competition, and regulatory compliance? All eyes are on March 2025 for the outcome.

Looking Ahead

This test is temporary, but its outcomes could shape future search engine functionalities in Europe and beyond. Marketers must stay agile, adapting to shifts in visibility and traffic distribution.

By focusing on SEO, leveraging comparison platforms, and optimizing the user experience, hotels can navigate these changes and maintain a strong online presence.

Are you ready to adapt your strategy to Google’s evolving search landscape?